Government Shutdown 2021 Child Tax Credit

And last updated 347 PM Jul 22 2021. Heres the impact of the shutdown on child tax credit payments travelers the post office tourism and the fight against COVID-19.

What To Know About September Child Tax Credit Payments Forbes Advisor

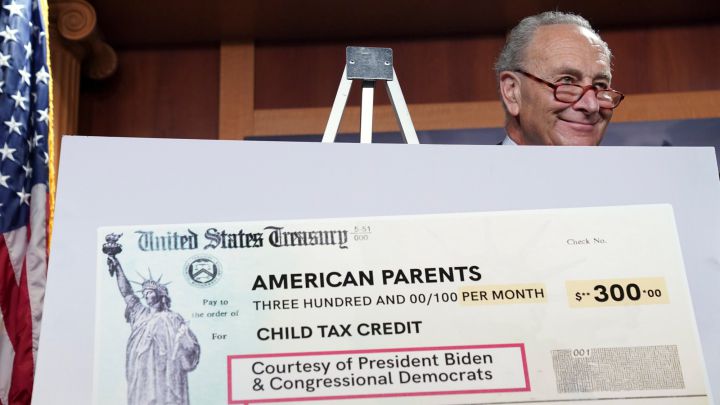

The American Rescue Plan enacted in March temporarily increased the child tax credit to 3000 for children 6 and older and 3600 for children under the age of 6 and provided for periodic advance payments of the refundable portion of the credit.

Government shutdown 2021 child tax credit. The effort increases the benefit from a 2000 credit taken annually when you. For tax year 2021 the Child Tax Credit is increased from 2000 per qualifying child to. Fortunately if your circumstances change you can opt out anytime in 2021 to stop receiving the rest of your remaining monthly advances even if youve already received the first few payments.

The payment for children. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. These enhancements expire at the end of 2021.

These changes apply to tax year 2021 only. Other delays can happen if a direct deposit is. The maximum annual Child Tax Credit rates are shown below.

Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly. 3 reasons to opt out of remaining monthly payments before Oct. In addition the credit was increased up to 3600 per year for children ages 5 and under at the end of this year on a.

Making the Expanded Child Tax Credit Permanent Would Cost Nearly 16 Trillion. Child Tax Credit family element. The next monthly payment goes out Oct.

15 barring any technical issue like the one that delayed many September installments. President Biden is now exploring how to make the ARPAs temporary expansion. 3000 for children ages 6 through 17 at the end of 2021.

The White House said about 60 of workers at the IRS the agency that distributes the child tax payments may be furloughed in a government shutdown. New 2021 Child Tax Credit and advance payment details Child Tax Credit amounts will be different for each family Your amount changes based on the age of your children. The first child tax credit payment was sent on July 15 and the second was sent on August 13.

Several changes were made to the child tax credit as part of the American Rescue Plan signed in March 2021. Republicans doubled the child tax credit to 2000 per child with their massive tax cut bill in 2017 but they rejected this new expansion which Democrats tucked into the Covid assistance bill. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

Enhanced Child Tax Credit. Under the new legislation individuals will qualify for the full value of the 2021 Child Tax Credit so long as their annual earnings are below 75000. The program provides the tax credit to all families with children including those who are not required to file a federal tax return.

But theres a catch. Rates per year 2021 to 2022. Child Tax Credit rates.

But those parents might. Eligible parents got the first advance child tax credit payment on July 15 with more partial installments being sent out through the end of 2021. The President is calling for the Child Tax Credit expansion first enacted in the American Rescue Plan to be extended.

You will claim the other half when you file your 2021 income tax return. The child needs to younger than 6 as of December 31 2021 to receive the full 300 credit. The enhanced Child Tax Credit CTC was signed into law by President Joe Biden as part of the American Rescue Plan.

Here are some cases where unenrolling from the 2021 advance child tax credit program could be a good idea. 3600 for children ages 5 and under at the end of 2021. As the third payment is anticipated to be mailed out September 15 delays could occur from the postal system or if the IRS has an incorrect mailing address meaning a check is sent to the wrong household.

Each child under age 6 could qualify for a maximum. The payment which is an advance on the money eligible American. The next round of advance child tax credit payments tens of millions of American families are set to go out in two weeks.

The 500 nonrefundable Credit for Other Dependents amount has not changed. Thats because the Child Tax Credit is. Families with children will see a significant increase in their maximum child tax credit CTC in 2021 thanks to the American Rescue Plan Act ARPA expanding child-related tax benefits.

Just days after the IRS sent millions of families checks as part of the enhanced child tax credit the agency is warning parents about scammers trying to. The roughly 35 million parents who are set to receive three more monthly installments of the enhanced child tax credit this year may.

Child Tax Credit Irs To Issue 2nd Round Of Advance Payments Friday Wnct

Irs Begins Issuing Second Round Of Economic Stimulus Payments In 2021 Irs Investment Advisor Investing

Child Tax Credit Why You May Want To Opt Out Of Monthly Payments This Week Whnt Com

Child Tax Credit Updates What Time What If Amount Is Wrong

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

Child Tax Credit Doubles Under Trump Administration

Child Tax Credit Update Eyewitness News

Why Your September Child Tax Credit Payment Is Delayed Wset

Child Tax Credit Can I Choose To Receive 3600 3000 Rather Than 300 250 Per Month As Com

Why Extending The Child Tax Credit Is The Right Thing To Do Roll Call

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Here S What You Need To Know About Child Tax Credit Payments The Washington Post

Haven T Had The Child Tax Credit Payments Here S How To Trace Your Check

American Rescue Plan Act 2021 Child Tax Credit Stimulus When You Can Get It How Much And Who Qualifies For It Marca

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Next Child Tax Credit Payment Will Be Sent Out In Less Than Two Weeks Here S How To Make Sure You Get Yours

Families With Children Too Old For Child Tax Credit Payments Can Still Get Relief Funds Here S How You Can Get Payout

Child Tax Credit How To Opt For One Big Payout Instead Of Monthly Checks Wsav Tv

0 Response to "Government Shutdown 2021 Child Tax Credit"

Post a Comment